What are the pros and cons of having Section 8 rentals?

Are you thinking about turning your rental properties into Section 8 rentals but you don’t know if this is a smart move to make or not?

Section 8 is often a controversial program among landlords but the reality is that this program does have it’s benefits since many landlords consider it to be a ‘recession proof’ program.

If you’ve been debating if Section 8 is the right opportunity for you or not, this article will provide you with tips for getting started with Section 8.

Pros of Section 8 in Recessions

Section 8 unquestionably has its advantages, especially during recessions and periods of high unemployment. Keep these perks in mind as you mull over Section 8 renters to fill your next vacancy.

Note that some states and cities require all landlords to accept Section 8 renters, so make sure you know your local laws before setting a policy.

Guaranteed Rent—or Most of It, Anyway

Section 8 typically pays the majority of participating tenants’ rent. So while they don’t normally pay every penny, you can bank on receiving most of the rent from the government every month like clockwork.

In a recession, that rental income reliability comes as a huge relief for most landlords, as rent default rates soar among unemployed cash tenants.

Section 8 Tenants Rarely Default

To begin with, Section 8 tenants just don’t have to come up with much money for rent each month. It’s a lot easier to come up with $200 than $1,500 each month, even if you take a pay cut or lose your job.

Beyond the tenant’s rent obligation being tiny compared to cash renters, voucher holders don’t want to jeopardize their vouchers by defaulting and getting evicted. That means Section 8 tenants typically do everything in their power to avoid defaults and eviction.

Lower Turnover Rates

Turnovers are cash flow killers. The overwhelming majority of landlord expenses—in both money and time—come from turnovers. This is precisely why landlords should focus on tenant retention as a tactic to boost their returns.

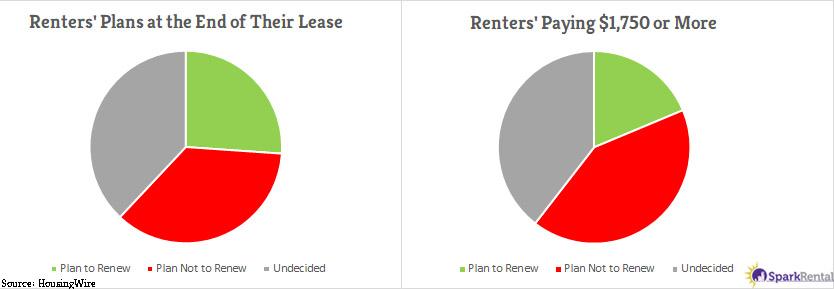

As it turns out, a frightening number of renters are currently planning to non-renew their lease agreements over the next year. Only 26.1% of renters plan to renew, and the numbers are even uglier among tenants paying higher rents.

In my experience, Section 8 tenants move less often than cash tenants. To begin with, they have a harder time finding new landlords who accept Section 8 vouchers. But they also fear losing the good thing they have going by kicking the bureaucratic hornet’s nest.

To change homes, they have to muddle through a swath of red tape and potentially undergo renewed scrutiny from the bureaucratic machinery. We should all harbor a healthy fear of such governmental machinery and its power to impact our finances with the wave of a pen.

Larger Pool of Eligible Tenants to Fill Vacant Units

If you don’t accept Section 8 tenants, you instantly eliminate a percentage of your prospective applicants. That can make it harder to fill vacant units.

Which, in turn, can mean longer vacancies, particularly during recessions when fewer renters can bring the financial stability that landlords screen for among their applications.

Cons of Section 8 Tenants

Section 8 renters come with plenty of downsides, as well. Make sure you fully understand them, before courting Section 8 tenants.

Initial & Annual Inspections

Section 8 requires an initial inspection, before greenlighting voucher holders to move into your property. And they can be… meticulous. They may require a series of additional updates or repairs before signing off on the lease.

Then you have to go through it every single year for lease renewal.

I’ve had particularly bad experiences with these. Like clockwork, inspectors would come up with $1,500-$2,000 worth of repairs every year—although that was the only consistency in their inspections.

I eventually learned that inspectors would find items to write up at every property they inspected. They did this for three reasons:

- First, it proved to their supervisor that they were hitting every home on their rounds.

- Second, it kept them in work, because they would have to go out and re-inspect the unit to verify the repairs were completed.

- Third, it kept them out of the office and the eyes of those same supervisors.

Bureaucratic machinery is not driven by market forces and efficiencies. They come with their own internal logic—one which typically serves to build evermore bureaucracy.

These inspections and subsequent mandated repairs can sap your returns for the entire year, defeating the entire purpose of owning rental properties.

Eviction Delays

Expect more red tape in trying to evict Section 8 tenants than cash tenants. Often landlords have to jump through additional hoops like submitting additional paperwork to the local Public Housing Authority before being allowed to file in court for eviction. This means longer periods of unpaid rent or other lease violations.

But rent defaults aren’t the only way that tenants can violate their lease. From damage and abuse to your property to hassling your neighboring tenants, from criminal activity to noise problems, you may need to evict bad apples even if the rent keeps flowing.

Non-Renewal Restrictions

In some jurisdictions, landlords can’t easily non-renew Section 8 tenants either. They may have to prove “just cause” if they don’t want to renew the lease agreement on their own property.

That can mean that it’s just as hard to get out of your arrangement with Section 8 as it is to get into it.

Less Investment Among Renters

People value items based on their own investment in them. A couple who works hard and saves for years for a down payment on a home will treat that home with tender care and respect, because they had to invest so much of themselves in order to achieve it.

Renters inherently have less financial investment in their homes, and as a group cause far more wear and tear on them than homeowners do. And Section 8 renters have the least investment of all in their homes, putting very little of their own money into rents each month.

In my experience, they’re harder on properties than cash tenants. With less skin in the game, it’s all too easy to take for granted the home you’re given.

Contact RPM Central Valley

For more information about the pro’s and con’s of Section 8 rentals, or to speak with us about our property management services, contact us today by calling (209) 572-2222 or click here.